This past week as we were meeting friends and family for Diwali, I found myself in two very different conversations about money — one with a 14-year-old who had just started earning, and another with a friend whose daughter will be heading to university next year. Both conversations, though separated by age and context, had the same underlying theme: how financial awareness begins, and why it matters early.

A 14-Year-Old, a Part-Time Job, and the First Lesson in Compounding

The first conversation happened with a teenager who had just started working part-time at a local restaurant. We were chatting casually when I asked him what he planned to do with his earnings.

He smiled and said, “I’m not sure — I haven’t really thought about it.”

That was my cue.

We started talking about something I wish I had understood at his age — the power of compounding. I explained that even small, consistent investments can quietly grow into something meaningful over time.

Together, we built a simple example.

What if he started investing just $5 a week at age 14, and increased that by $5 each year, until he reached $50 a week by age 20?

We assumed a realistic 7% annual return, roughly in line with what diversified markets have averaged over the long term.

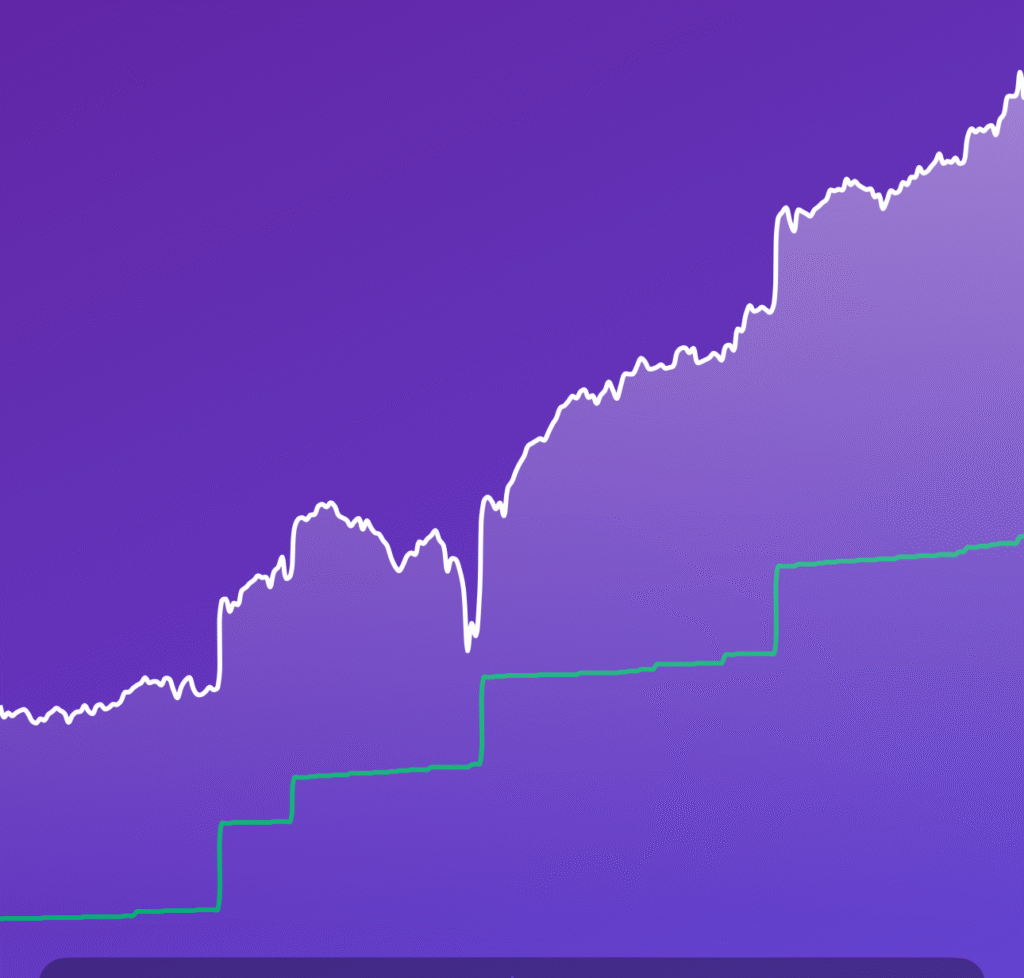

At first, he was polite but skeptical. A few dollars a week didn’t sound like much. But then we did the math. By age 20, he would have put in just over $8,000, and through compounding, that could grow to around $9,200.

“Okay,” he said, “that’s kind of cool.”

So we took it further. If he kept investing $50 per week after that — not increasing, not chasing the market, just staying consistent — his contributions over 20 years would total roughly $32,000.

At a 7% return, that could grow to about $52,000 by age 34, and close to $85,000 by age 39.

It wasn’t about becoming rich; it was about understanding what consistency does.

He began to see how steady, small actions compound quietly over time — and how patience, not perfection, creates results.

Then we took the conversation one step further. We spoke about the importance of balance — splitting his earnings into two buckets:

- One for spending, where he could buy things he enjoys or experiences he values.

- And one for saving, for the future — something he wouldn’t touch for now.

I told him he didn’t have to spend everything in his “spend” bucket. The goal wasn’t restriction — it was awareness. He should know that he has money for things he enjoys, but also learn that part of what he earns can quietly grow in the background.

By the end of our chat, he understood that money isn’t just something to earn and spend — it’s something to manage thoughtfully. And that’s a life skill, not a math lesson.

And here’s the great part — he’s already taken his first step.

He has started investing small amounts through CommBank Pocket, exploring ETFs like “Global 100” and “Tech Savvy”

But like many young investors, he’s discovered a practical challenge: the high unit prices of ETFs make small regular investments difficult to sustain.

So we discussed alternatives — low-cost, low-fee platforms that allow micro-investing with smaller, more frequent contributions. It’s an important lesson for young investors: the best investment platform is the one that makes consistency easy.

That conversation ended with a smile and a sense of curiosity — the spark of someone who had just discovered that his money can quietly grow while he focuses on life.

When Awareness Meets Parenthood

A few days later, I caught up with a friend whose daughter will be starting university next year. Our conversation drifted — as it often does — toward how different things are today compared to when we grew up in India.

We spoke about how financial awareness wasn’t really part of our upbringing. Money was discussed in broad strokes: save, don’t waste, and maybe invest — but never how or why. We figured things out the hard or the long way.

That led us to a deeper reflection on what we, as parents, can do differently now. Especially when it comes to helping our kids — and particularly our daughters — develop a healthy, confident relationship with money.

I shared what we’ve been doing at home for the past few years. When my kids were younger, we started with the Barefoot Investor’s three jars — Spend, Smile, and Save.

Those three jars sat on a shelf where we could all see them. Each week, as they received their allowance based on the simple jobs they do at home, we’d talk about what goes where:

- The Spend jar was for immediate wants — things they could enjoy now.

- The Smile jar was for experiences or giving — something that brought joy or helped others.

- And the Save jar was for the long term — money that simply stayed put.

As they grew older and could grasp the concept of digital money, we started moving things online. Their Spend and Smile amounts now go into their own bank accounts, while the Save portion is invested through Raiz Kids accounts.

They have read-only access, so they can log in and see how their money is growing, changing, and sometimes even shrinking. Earlier this year, during the market dip in early 2025, both of them saw their balances fall and asked why.

That moment turned into an unexpected teaching opportunity — a chance to talk about market cycles, patience, and the idea that growth isn’t always a straight line.

Now, every few weeks when (and if) they have done their weekly jobs, get the money and we go through their allowance, we follow a small ritual:

we talk about what they’ve earned, what they’ve saved, and what’s happening to their investments. The goal isn’t perfection — it’s awareness.

What I’ve realised is that these small, repeated conversations are slowly shaping how they see money. It’s no longer an abstract number in an app — it’s something that flows, fluctuates, and demands thought.

Before that conversation with my friend ended, we also touched on something even broader — that financial literacy is deeply connected to personal safety and independence.

As kids grow up, especially in a world that’s increasingly digital and complex, they need to learn not just how to make money, but how to protect themselves and what they have.

That’s probably a topic for another day, but it’s part of the same continuum — helping our kids develop confidence, awareness, and resilience when it comes to both money and life.

This week’s conversations reminded me that financial literacy isn’t about teaching kids to calculate returns — it’s about helping them connect with the idea of flow. Money comes in, moves out, grows, dips, and comes back again.

If they can understand that early — without fear, guilt, or confusion — they’ll make far better decisions later.

If you have reached till here, I would appreciate if you share this with atleast one person who would get some value from the post and let me know what you think about it.

Liked the concept of spend , smile and save jars!

Looking forward to read more on introducing financial literacy to pre teens other than piggy banks..

Also a view will be appreciated on investing in crypto vs traditional but safe investment tools like mutual funds , digital gold , provident fund and pension plans

Isha, I think simplicity and consistency works well.. my son is only 10 and we have been working on the jars system for over 2 years now.. he saved for an Apple Watch on his own (and we bought a used one earlier this year, with me contributing 50% of the cost and rest from his savings). He wears it with a ton of pride. This is when I gave him the idea of moving to a digital account as he was not possibly dealing with sufficiently large amounts of money which did not make sense being in a jar.

I am unable to comment o Crypto to be honest as that’s a vehicle I have no clue about…I have some investments in it, but they are almost as good as nothing and I wouldn’t mind losing the entire amount as it was always play money (my spend money from my jar, so to speak).

In the last 10 years, I have almost removed myself from investments in India so a perspective of what works there is something that I am not able to offer unfortunately.